Bearish Candlestick Patterns PDF Free Download, Bearish candlestick patterns with examples, Bearish candlestick patterns explained

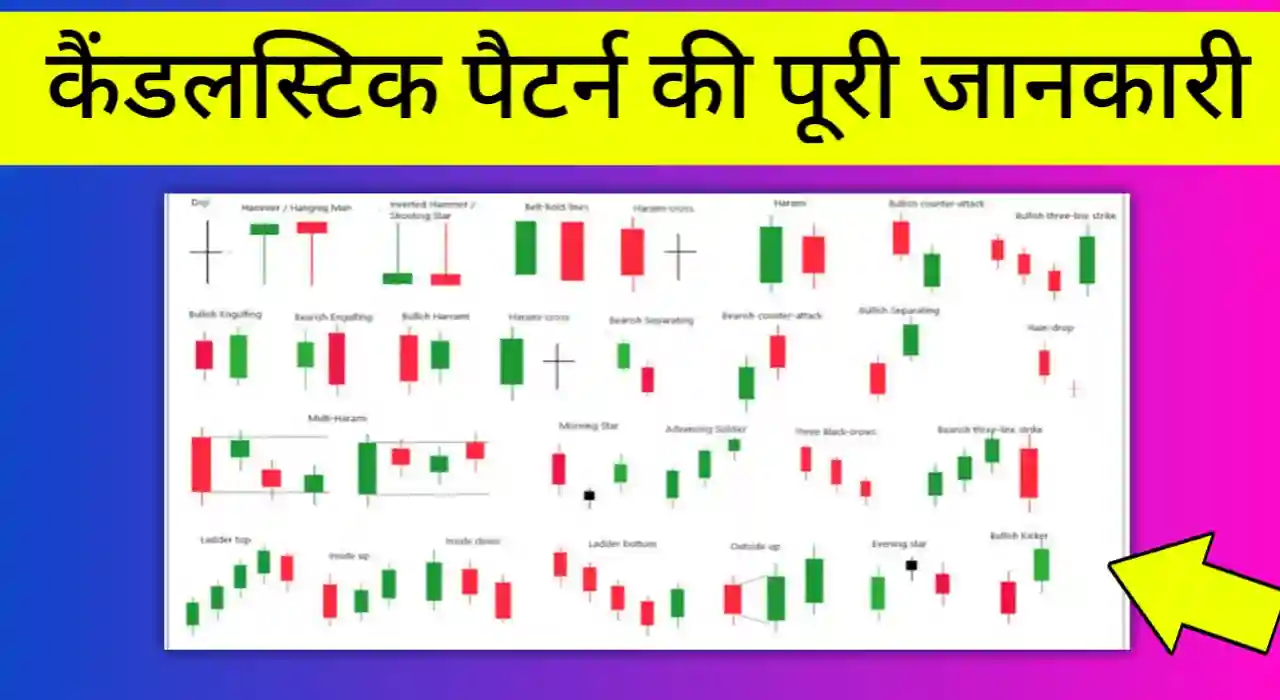

If you want to make daily profit by trading candlestick patterns then this article is for you. Because today we will give you a Bearish Candlestick Patterns PDF cheat sheet for free download.

Today we will talk about 10 types of Bearish Candlestick Chart Patterns in details and you can also download this Bearish Candlestick Patterns PDF for Free.

Bearish Candlestick Patterns PDF Free Download

Here are the details of this bearish candlestick patterns pdf–

| PDF Name | Bearish Candlestick Patterns With Example |

|---|---|

| Language | English |

| Format | |

| Pages | 16 |

| Ratings | 4.9/5 |

| Author | Deepak Sen |

| Total patterns | 10 |

| PDF Size | 2.5 MB |

| Download Link | Given Below |

Bearish candlestick patterns Cheat Sheet PDF Free Download

What is Bearish Candlestick Patterns?

Bearish candlestick patterns are chart patterns in trading that suggest a potential price decline. They signal investor pessimism and can help predict falling prices.

- Examples include the “Bearish Engulfing” where a smaller bullish candle is followed by a larger bearish one.

Bearish patterns are very important for traders to identify downwards trend in stock market and to make informed decisions and manage risks in trading.

All Bearish Candlestick Patterns PDF Download Free

Now let’s know about all Bearish candlestick patterns with example one by one, The First Pattern is–

1. Shooting Star Candlestick Pattern

The “Shooting Star” is a bearish candlestick pattern that indicates a potential trend reversal from bullish to bearish.

It forms after an uptrend and signals a weakening of buying pressure. Here’s how it looks:

- Opening price is typically higher than the closing price of the previous day.

- The price moves higher during the day.

- However, by the end of the day, the price retreats significantly, closing near or below the opening price.

- It has a small real body (the difference between the opening and closing prices) and a long upper shadow (the distance between the high and closing prices).

Example:

Imagine a stock in an uptrend. The previous day, it closed at 50 Rs, and the next day it opened at 52 Rs. During the day, it reached a high of Rs 54 but closed at Rs 51, forming a Shooting Star candle.

How to trade the Shooting Star Candlestick Pattern:

- Entry: Consider entering a short (sell) position when the next candle confirms the pattern by closing below the Shooting Star’s low, indicating bearish momentum.

- Stop Loss: Place a stop-loss order above the Shooting Star’s high to limit potential losses if the trend reverses.

- Target: Set a target based on your risk-reward ratio, but common practice is to aim for the recent support level or the lower Bollinger Band.

2. Hanging Man Candlestick Pattern

The “Hanging Man” is a bearish candlestick pattern that warns of a potential trend change.

It forms after an uptrend and signals that the upward momentum might be weakening. Here’s how it looks:

- It appears after a period of rising prices.

- The opening price is usually higher than the previous day’s closing price.

- During the day, the price goes up significantly.

- However, by the end of the day, it closes near or below the opening price.

- It has a small body (the difference between the opening and closing prices) and a long shadow pointing down.

Example:

Imagine a stock that has been going up. The day before, it closed at Rs 60, and the next day it opened at Rs 62. During the day, it went as high as Rs 64 but closed at Rs 61, forming a Hanging Man candle.

Trading the Hanging Man:

- Entry: Think about selling when the next candle confirms the pattern by closing below the Hanging Man’s low, suggesting a potential shift to a bearish trend.

- Stop Loss: Put a stop-loss order above the Hanging Man’s high to limit potential losses if the trend reverses.

- Target: Set a goal based on your risk-reward ratio, often targeting recent support levels or the lower Bollinger Band.

3. Bearish Engulfing Candlestick Pattern

The “Bearish Engulfing” is a important bearish candlestick pattern signaling a potential reversal from an uptrend to a downtrend.

It occurs when a larger bearish candle completely engulfs a preceding smaller bullish one. Here’s a simplified explanation:

- It happens after a period of rising prices.

- The first candle in the pattern is a small bullish one (green or white).

- The second candle is a larger bearish one (red or black), and it completely covers or “engulfs” the first candle.

- This pattern suggests a shift from buyer control to seller control.

Example:

Imagine a stock that’s been going up. On the first day, it had a small green candle, closing at Rs 65.

The next day, it opened higher at Rs 66 but then experienced a significant drop and closed at Rs 63, completely covering the previous day’s candle.

Trading the Bearish Engulfing:

- Entry: Consider selling when you see a Bearish Engulfing pattern, indicating potential bearish momentum. Wait for the second candle to close to confirm the pattern.

- Stop Loss: Place a stop-loss order above the high of the engulfing candle to manage risk in case the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio. It’s common to target recent support levels or lower Bollinger Band.

Also Read: Stop Loss Meaning in Hindi

4. Dark Cloud Cover Candlestick Pattern

The “Dark Cloud Cover” is a bearish candlestick pattern that warns of a potential trend reversal from bullish to bearish.

It forms when a bearish candle follows a strong bullish one and suggests a shift in market sentiment. Here’s a simplified explanation:

- It occurs after an uptrend.

- The first candle is a large bullish one.

- The second candle is bearish and opens above the previous day’s high.

- The bearish candle closes below the midpoint of the bullish candle, creating a dark cloud-like appearance.

Example:

Imagine a stock in an uptrend. On the first day, it had a strong bullish candle, closing at Rs 70.

The next day, it opened higher at Rs 75 but then declined significantly and closed at Rs 72, below the midpoint of the previous day’s candle, forming a Dark Cloud Cover.

Trading the Dark Cloud Cover:

- Entry: Consider selling when you spot a Dark Cloud Cover pattern, indicating potential bearish reversal. Wait for the second candle to close for confirmation.

- Stop Loss: Place a stop-loss order above the high of the bearish candle to manage risk in case the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

5. Evening Star Candlestick Pattern

The “Evening Star” is a bearish candlestick pattern that warns of a potential reversal from a bullish trend to a bearish one.

It consists of three candles and signifies a weakening of upward momentum. Here’s a simplified explanation:

- The first candle is a strong bullish one, indicating a robust uptrend.

- The second candle is smaller and typically has a small real body, suggesting indecision in the market.

- The third candle is a bearish one that closes below the midpoint of the first bullish candle, indicating a potential trend reversal.

Example:

Imagine a stock in an uptrend. The first day, it had a strong bullish candle, closing at Rs 80.

The second day, there’s indecision, resulting in a small candle with a close at Rs 82.

On the third day, a bearish candle forms, closing at Rs 78 and below the midpoint of the first bullish candle, creating an Evening Star pattern.

Trading the Evening Star:

- Entry: Consider selling when you identify the Evening Star pattern, as it suggests potential bearish reversal. Wait for the third candle to close for confirmation.

- Stop Loss: Place a stop-loss order above the high of the third bearish candle to manage risk if the trend doesn’t reverse as anticipated.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

6. Three Black Crows Candlestick Pattern

The “Three Black Crows” is a bearish candlestick pattern that signals a strong reversal of an existing uptrend.

It consists of three consecutive long and bearish candles.

- It forms during an uptrend, with the first candle being bullish.

- The second, third, and subsequent candles are bearish, opening within the previous candle’s body and closing near their lows.

- Each of the three bearish candles should be longer and show a clear downward movement.

Example:

Imagine a stock that has been rising. On the first day, it had a bullish candle, closing at Rs 90.

The next three days saw consecutive bearish candles with closing prices of Rs 87, Rs 84, and Rs 81, forming a Three Black Crows pattern.

Trading the Three Black Crows:

- Entry: Consider selling when you spot the Three Black Crows pattern, suggesting a strong potential for a bearish reversal. Confirmation is essential, so wait for the third bearish candle to close.

- Stop Loss: Place a stop-loss order above the high of the third bearish candle to manage risk in case the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

7. Three Inside Down Candlestick Pattern

The “Three Inside Down” is a bearish candlestick pattern that signifies a potential reversal of an uptrend.

It consists of three candles and implies a shift from bullish to bearish sentiment. Here’s a simplified explanation:

- The first candle is a strong bullish one, confirming the existing uptrend.

- The second candle is bearish and has a smaller real body, but it closes within the previous bullish candle’s range.

- The third candle is also bearish and closes below the second candle’s low, indicating a potential trend reversal.

Example:

Imagine a stock in an uptrend. On the first day, it had a strong bullish candle, closing at Rs 100.

The second day, a smaller bearish candle formed, closing at Rs 98 but within the range of the previous day’s candle.

On the third day, a bearish candle closed at Rs 95, below the low of the second candle, forming a Three Inside Down pattern.

Trading the Three Inside Down:

- Entry: Consider selling when you identify the Three Inside Down pattern, suggesting potential bearish reversal. Wait for the third candle to close for confirmation.

- Stop Loss: Place a stop-loss order above the high of the third bearish candle to manage risk in case the trend doesn’t reverse as anticipated.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

8. Gravestone Doji Candlestick Pattern

The “Gravestone Doji” is a bearish candlestick pattern that suggests a potential reversal from an uptrend to a downtrend.

It is characterized by a small body at the bottom of a long upper shadow and typically forms after an extended bullish run.

- The opening price and closing price of the candle are usually the same or very close.

- There’s a long upper shadow, indicating that at some point during the trading period, the price rose significantly.

- The lower shadow is either non-existent or very short.

Example:

Imagine a stock that has been trending upward. On a particular day, it opens at Rs 110 and experiences significant buying pressure, driving the price to a high of Rs 115.

However, by the end of the day, it closes right back at Rs 110, forming a Gravestone Doji.

Trading the Gravestone Doji:

- Entry: Consider selling when you spot a Gravestone Doji after a bullish trend, suggesting potential bearish reversal. Confirmation is essential, so wait for the next candle to close below the Gravestone Doji.

- Stop Loss: Place a stop-loss order above the high of the Gravestone Doji to manage risk if the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

9. Bearish Harami Candlestick Pattern

The “Bearish Harami” is a bearish candlestick pattern that signals a potential reversal from an uptrend to a downtrend.

It consists of two candles and represents a shift in market sentiment. Here’s a simplified explanation:

- The first candle is a large bullish one, indicating the current uptrend.

- The second candle is smaller and bearish, with its body completely enclosed within the range of the first bullish candle.

- This smaller bearish candle is what forms the “harami,” which means “pregnant” in Japanese, signifying a potential reversal.

Example:

Imagine a stock in an uptrend. On the first day, it had a strong bullish candle, closing at Rs 120.

The next day, a smaller bearish candle formed, closing at Rs 118, entirely within the range of the previous day’s candle, creating a Bearish Harami pattern.

Trading the Bearish Harami:

- Entry: Consider selling when you spot the Bearish Harami pattern, suggesting a potential bearish reversal. Wait for the second bearish candle to close for confirmation.

- Stop Loss: Place a stop-loss order above the high of the second bearish candle to manage risk if the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

10. Tweezer Top Candlestick Pattern

The “Tweezer Top” is a bearish candlestick pattern that indicates a potential reversal in an uptrend.

It forms when two candlesticks have almost identical highs, suggesting a struggle between buyers and sellers.

- The first candle is bullish, indicating an ongoing uptrend.

- The second candle is also bullish but has the same or nearly the same high as the first candle.

- This pattern indicates that buyers couldn’t push the price higher, possibly signaling a weakening of bullish momentum.

Example:

Imagine a stock in an uptrend. On one day, it had a strong bullish candle, closing at Rs 150.

The next day, it opened higher at Rs 155 and rallied but closed at Rs 150, creating a Tweezer Top pattern with nearly identical highs.

Trading the Tweezer Top:

- Entry: Consider selling when you identify the Tweezer Top pattern, as it suggests a potential bearish reversal. Wait for confirmation from the next candle closing below the low of the Tweezer Top.

- Stop Loss: Place a stop-loss order above the high of the Tweezer Top to manage risk if the trend doesn’t reverse as expected.

- Target: Set a target based on your risk-reward ratio, often aiming for recent support levels or the lower Bollinger Band.

So These were 10 most popular Bearish Candlestick Patterns. You can make money by trading all these chart patterns.

List of Bearish Candlestick Patterns Names

| Sr. No. | Bullish Pattern Name |

|---|---|

| 1. | Shooting Star Candlestick Pattern |

| 2. | Hanging Man Candlestick Pattern |

| 3. | Bearish Engulfing Candlestick Pattern |

| 4. | Dark Cloud Cover Candlestick Pattern |

| 5. | Evening Star Candlestick Pattern |

| 6. | Three Black Crows Candlestick Pattern |

| 7. | Three Inside Down Candlestick Pattern |

| 8. | Gravestone Doji Candlestick Pattern |

| 9. | Bearish Harami Candlestick Pattern |

| 10. | Tweezer Top Candlestick Pattern |

So This is the List of All Bearish Candlestick Patterns.

When you will do trading and stock market then you will see these patterns are forming everyday on charts.

And you can trade these Japanese Bearish candlestick patterns by following above guide that I provide you.

You can also download the PDF guide of all these Bearish candlestick patterns absolutely free.

Now let’s know about how to download Bearish candlestick patterns pdf for free–

How to download Bearish candlestick patterns pdf?

Here are some basic steps to download Bearish candlestick patterns PDF Free–

- First of all click on this link to download Bearish candlestick patterns PDF.

- After clicking on the link you will be redirect to the Google drive page.

- On this page you can read the PDF cheat sheet about Bearish candlestick patterns.

- To download Bearish candlestick chart patterns in PDF, you can see the download icon in the top right corner so click on that download icon.

- After clicking, your Bearish candlestick pattern PDF will be downloaded absolutely free.

I hope now you know that how to download free Bearish candlestick patterns cheat sheet PDF.

- Chat Patterns PDF Free Download in Hindi

- Chart Patterns Cheat Sheet PDF Download Free

- All Candlestick Patterns in Hindi

Bearish Candlestick Patterns PDF Free Download – FAQ’s

How much Bearish candlestick patterns available in this Pdf?

There are total 10 bearish candlestick chart patterns available in this PDF that you can download free. By learning these all candlestick patterns you can make daily profits in the stock market.

Are all candlestick patterns free to download in this cheat sheet PDF?

Yes, all bearish candlestick chart patterns are free to download in this cheat sheet PDF.

What is the best Bearish candlestick pattern?

Shooting star and Hanging man are the best bearish candlestick patterns in stock market that gives huge profits to traders. There are also some good bearish candlestick patterns like; Evening star, Bearish engulfing, Gravestone Doji, Bearish Harami,

Tweezer Top etc.

What is the most common Bearish chart pattern?

The most common bullish candlestick patterns are hammer, Shooting star, Hanging man, Bearish engulfing and Bearish Harami. You will see all these bearish patterns daily forming on charts.

Bearish Chart Patterns PDF Download ‘Conclusion’

In this post (Bearish Candlestick Patterns PDF Free Download) we have explained 10 types of Bearish Candlestick Patterns with examples.

We have also told you how to trade all these Candlestick Patterns like; where you can take entry, where to set stop loss and target and we have to exit.

All these things we have explained in each Bearish pattern we mentioned in this post.

So if you are a beginner in trading then I hope this post will be very useful for you.

If you have any question related trading or any candlestick patterns then you can ask me in the comment section below.

ALSO READ;

- Bullish Candlestick Patterns PDF Free Download

- Best Option Trading Book in Hindi

- Best Candlestick Pattern Book in Hindi

- Share Market – A to Z Pdf Free Download in Hindi

- Best Share market course in Hindi

- Technical analysis PDF in Hindi

- Fundamental analysis PDF in Hindi

| 🔥 Whatsapp Group | 👉 यहां क्लिक करें |

| 🔥 Telegram Group | 👉 यहां क्लिक करें |

![Bullish Candlestick Patterns PDF Free Download – [3 MB] Bullish Candlestick Patterns PDF Free Download](https://www.stockmarkethindi.in/wp-content/uploads/2023/10/20231003_225808_5577.webp)

![चार्ट पैटर्न PDF Free Download in Hindi – [604 KB] Chart Patterns PDF Free Download in Hindi](https://www.stockmarkethindi.in/wp-content/uploads/2023/08/chart-patterns-pdf-free-download-in-hindi.webp)